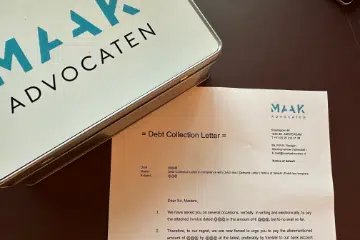

international debt collection in the Netherlands starts with a mandatory extrajudicial phase. This initial step aims to amicably resolve the debt without court intervention, often through written reminders to the debtor.

Extrajudicial Collection: The First Approach

In this phase, the focus is on direct communication with the debtor to encourage payment. This could involve outlining potential legal consequences or negotiating payment terms. It’s a critical step, as it sets the tone for possible future legal actions and often determines the debtor’s willingness to cooperate. MAAK Advocaten will provide you with the most important elements.

Transitioning to Judicial Debt Collection

The Judicial Collection Process

If extrajudicial efforts fail, creditors may resort to the judicial collection process. Determining the competent court often depends on the contractual agreement between the parties. In the absence of such stipulations, typically, the court in the place of delivery, which would be a Dutch court, is considered competent.

Dutch Court Judgments and Debt Collection

With a Dutch court judgment, creditors have several options:

- Prejudgment Attachment: Securing the debtor’s assets before judgment.

- Initiating Ordinary Civil Proceedings: Seeking court orders for debt repayment.

- Filing for Bankruptcy: Applying pressure on the debtor, often requiring support from another creditor.

Handling Foreign Judgments in the Netherlands

International cases, where a non-Dutch court is involved, are handled differently:

- EU Member State Judgments: Recognized without needing a Dutch court’s declaration.

- Non-EU Member State Judgments: Depend on existing treaties and may require re-litigation in Dutch courts.

Special Regulations within the EU Framework

European Order for Payment Procedure

This streamlined process allows for the quick collection of undisputed pecuniary claims across the EU, barring Denmark. It culminates in a European order for payment, enforceable against the debtor.

European Account Preservation Order (EAPO)

This procedure enables creditors to freeze the debtor’s bank accounts across the EU. It’s executed by Dutch procedures when applied in the Netherlands.

Professional Assistance in Debt Collection

MAAK Advocaten offers expert legal advice for international and national debt collection. Their services include strategizing extrajudicial collection efforts and navigating through the complexities of judicial processes, ensuring efficient and effective debt recovery.

Q&A Section

Q1: What is the first step in debt collection in the Netherlands?

A1: The first step is the extrajudicial process, where efforts are made to persuade the debtor to pay without involving the courts.

Q2: How does the Dutch court handle international debt collection cases?

A2: For EU judgments, no Dutch court declaration is needed. For non-EU cases, it may depend on treaties, and re-litigation in Dutch courts could be necessary.

Q3: What are some alternative EU procedures for debt collection?

A3: Alternatives include the European Order for Payment and the European Account Preservation Order, facilitating quicker and more direct debt recovery methods.